NJ Group is based in Surat, Gujarat, with a strong presence across India. Today, it is

a leading player in the Indian financial services industry. The journey started from humble beginnings in 1994

with the establishment of NJ India Invest Private Limited, the flagship company, to cater to investor needs in

the financial services industry. After traversing through initiatives in various B2C services, NJ Wealth -

Financial Products Distributors Network was established in the year 2003. Today, NJ Wealth is among the largest

network of financial products distributors in India, with an AUM of over

2,86,991 Crore.

Over the years, NJ Group has also diversified into various sectors,

establishing a presence in businesses ranging from financial products distribution to asset management,

insurance broking, NBFC, training and development, technology, and FMCG. Our rich experience in financial

services, combined with exceptional execution capabilities, strong processes, and a system orientation, has

enabled us to shape a rising growth trajectory in our businesses.

Factor investing is an investment strategy that focuses on selecting securities based on

specific characteristics or factors believed to drive their returns.

These factors can include attributes such as value, size, momentum, quality, and volatility.

Learn more about how factors can help generate high risk adjusted returns.

Explore the world of factor based investing on our website www.njmutualfund.com where you can access

resources such as NJ's Factor Book, NJ's Chartbook, The Factor Frontier, Blogs, and other factor related

information.

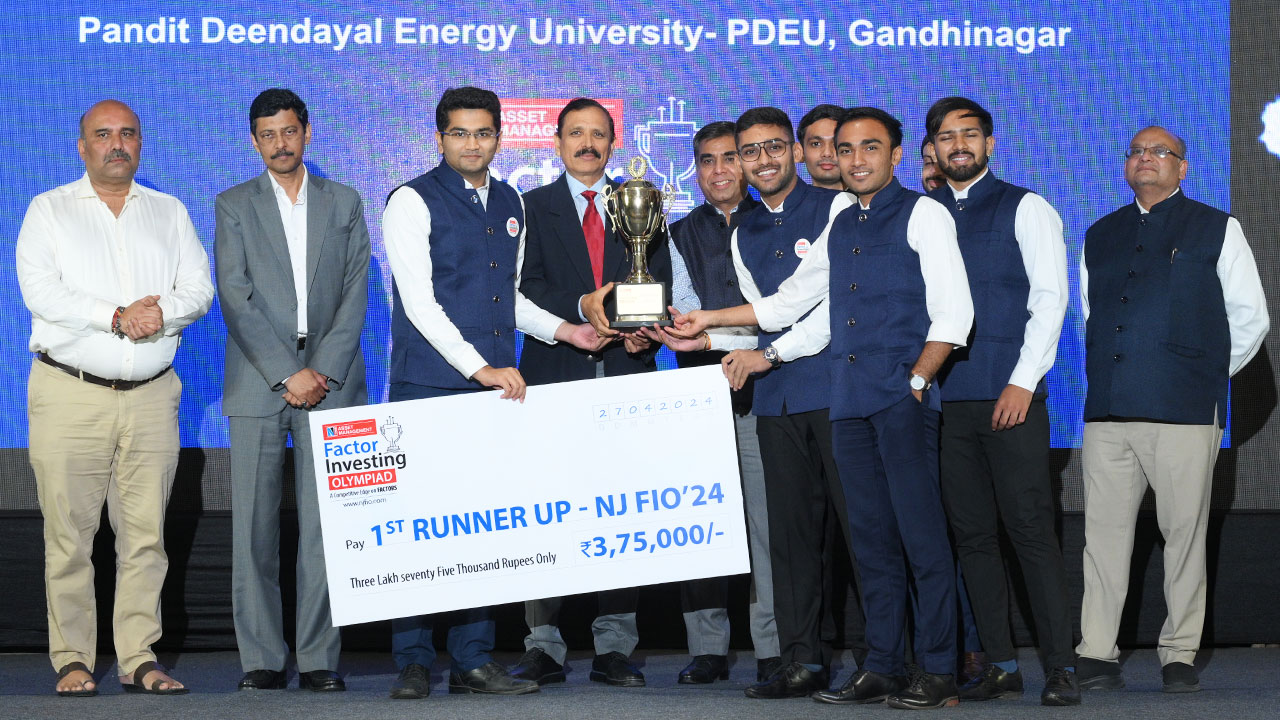

NJ Factor Investing Olympiad: An Annual Competition in Factor Investing for India's Top B-Schools

The NJ Factor Investing Olympiad (NJ FIO) offers a unique platform for students from India's premier business schools to tackle real-world challenges encountered by investment managers. This annual competition is rooted in the principles of factor investing, a globally recognized investment strategy that is rapidly gaining traction in India for portfolio construction.

We invite eligible B-School students to form teams of five and showcase their analytical and strategic skills in this distinctive and demanding competition! Join the challenge now.

The NJ Factor Investing Olympiad is a unique knowledge

initiative by NJ Asset Management Company (NJ AMC) dedicated to advancing awareness

about rule-based and factor investing, disciplines that are reshaping modern investment

thinking.

With a strong emphasis on education and empowerment, NJ FIO serves as a

platform to nurture the next generation of informed investors. This initiative reflects

NJ AMC's broader commitment to responsible investing and

knowledge-sharing, driven by the belief that spreading financial literacy is a shared

societal responsibility.

Indian School of Business Mohali

TEAM ALPHAEDGE

Indian School of Business, Hyderabad

TEAM FACTORIAL

Indian Institute of Management, Ahmedabad

TEAM ALPHAVAULT

Indian Institute of Management, Raipur

TEAM ALPHA GENERATORS

Participating in the competition gives you a unique edge in the world of factor investing. You will gain knowledge and experience in one of the fastest growing fields in asset management, providing you with skills that would be highly valued by any asset management firm.

NJ Smart Beta is a proprietary research platform developed by NJ AMC. The NJ Smart Beta platform allows researchers to use a wide range of factor parameters that have been rigorously tested for robustness and analyse present favourable risk and return characteristics.

One of the key features of the NJ Smart Beta platform is its ability to dynamically combine multiple factors, weighting methodologies, and select a suitable universe for constructing model portfolios. This flexibility allows researchers to tailor portfolios according to specific investment objectives and preferences.

To support the platform, we have curated a vast dataset covering data from over 1,200 companies spanning a period of 20 years. This rich and extensive dataset provides the foundation for sound research and informed decision-making, enhancing the reliability and accuracy of our investment strategies.

For the competition, we encourage participants to use the NJ Smart Beta platform to help solve the competition. It provides them with access to institutional grade factor based research platform. The use of NJ Smart Beta is NOT mandatory for solving the competition.

To learn more about the NJ Smart Beta platform and its capabilities, we invite you to watch our informative video.

Watch Video